By Daily Sports on August 8, 2018

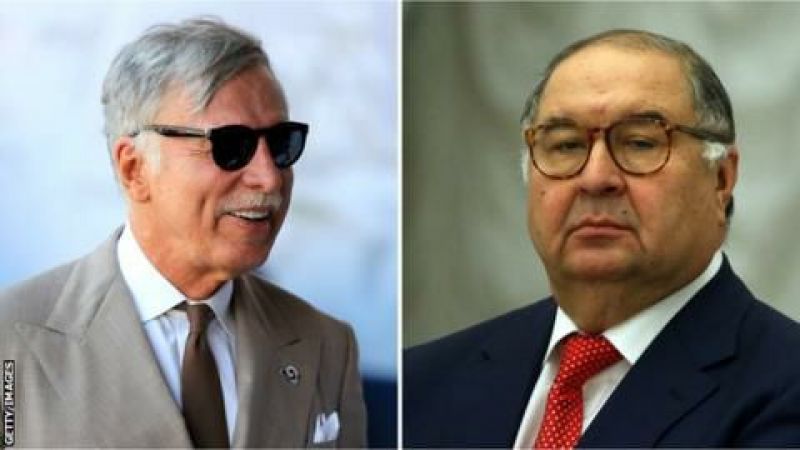

Arsenal shareholder Alisher Usmanov says he will accept rival Stan Kroenke's bid to buy him out for £550m and take full control of the club.

American billionaire Kroenke owns 67% of Arsenal through his company KSE and announced on Tuesday he had made an offer to buy up the rest of the shares.

Usmanov has confirmed he has agreed to part with his 30% stake in the club.

"I have decided to sell my shares in Arsenal, which could be the best football club in the world," he said.

Despite his shareholding, Usmanov is not part of the board or the decision-making at Arsenal.

The metal magnate made a £1bn bid to buy the Emirates outfit in May 2017 but this was rejected by Kroenke.

Kroenke's offer to shareholders values the Gunners at £1.8bn. Acquiring Usmanov's shares for £550m means remaining shareholders would be legally obliged to sell theirs to Kroenke.

The KSE statement to the London Stock Exchange said taking the club private will help to further Arsenal's "strategy and ambitions".

"KSE's ambitions for the club are to see it competing consistently to win the Premier League and the Champions League, as well as the major trophies in the women's senior game and at youth level," it added.

Arsenal have a new manager in charge this season after Unai Emery took over from Arsene Wenger, who had been Gunners boss for 22 years.

In Wenger's final season, Arsenal finished sixth in the Premier League as they missed out on the Champions League but qualified for the group stages of the Europa League.

The Gunners start their Premier League campaign against champions Manchester City on Sunday.

A 'dreadful day' for Arsenal - fans' reaction

While Kroenke says taking sole ownership will benefit the club, the Arsenal Supporters' Trust (AST) called the news "a dreadful day" for the Gunners.

"Stan Kroenke taking the club private will see the end of supporters owning shares in Arsenal and their role upholding custodianship values," said an AST statement.

AST added that by becoming the 100% owner, Kroenke would be able to take "detrimental actions" such as paying "management fees and dividends without any check or balance".

It added: "The AST is also extremely concerned to note that this purchase is being funded by a loan.

"The AST is wholly against this takeover which marks a very sad day for Arsenal football club."

Analysis - what does single ownership mean?

Rob Wilson, football finance expert at Sheffield Hallam University

There are two sides to this and from a fan's point of view you like to have a bit more transparency - when there is more than one person involved you get a broader discussion about what you should do, who you should buy and how much to spend on particular people.

When you have this single ownership, particularly when it will be set up in the United States, it lacks a bit of transparency.

There will be big dividends getting paid out from the football club as a profit maximising entity, but for Arsenal that's not really any different to what they have had for the past 10 or 15 years with Usmanov and back when Farhad Moshiri (former shareholder and Everton co-owner) was involved.

The only thing that concerns me is it's going to be a leveraged buy-out, so he's going to have to borrow to be able to do it. Depending on which side of the fence you're on will determine whether you see that as a positive or a negative thing.

From a purely business point of view, it's not a bad model. It's like you or I buying a house, taking out a mortgage, if you maintain those payments against those loans or however you borrowed then it is not a problem.

While the leverage is there that would have to be paid back, I don't think it will limit the activity Arsenal will be able to undertake in the transfer market as the reality is in order to make that business profitable, you have to be finishing in the top four and going into European competition.

What are the details of the offer?

Kroenke will be raising the capital to take control of the club with £45m of his own money and borrowing £557m, which he says will not be against the club.

"The offer is not being funded by way of any debt finance (bank loans, payment in kind loans or other debt or quasi debt interest bearing obligations) for which the payment of interest on, repayment of, or security for any liability (contingent or otherwise) will depend on the business of Arsenal," said KSE's statement.

In the offer document, each of Arsenal's 62,217 shares are valued at at £29,419.64.

KSE currently has 41,743 of those, with Usmanov holding a stake of 18,695, which would be worth £550m under the offer.

Acquiring Usmanov's shares would move KSE past the 90% threshold at which, under the Companies Act, they would be able to compulsorily purchase the remaining 1,779 shares, which are valued at £52.3m.

Apart from Arsenal, Kroenke's "family portfolio" of assets also include NFL side Los Angeles Rams, the NBA's Denver Nuggets, the NHL outfit Colorado Avalanche, MLS side Colorado Rapids and Colorado Mammoth of the National Lacrosse League. (BBC)

•Photo shows Kroenke (L) and Usmanov

Source Daily Sports

Posted August 8, 2018

You may also like...

Australian Open 2018: Elise Mertens shocks Elina Svitolina...

PSG favourites to land Pierre-Emerick Aubameyang

Ighalo’s Rollercoaster Journey Berths In United

Arsenal get new manager

Volleyball Premier League: Customs, NSCDC Remain Unbeaten

Ibenegbu Bids Enyimba, Fans Goodbye •His Moving Letter...

_9.jpg) NPFL: Rangers win big as Nasarawa shock Abia

NPFL: Rangers win big as Nasarawa shock Abia Nigeria know World Table Tennis Champs foes today

Nigeria know World Table Tennis Champs foes today Bayelsa athletics boss Oredipe maps out dev plans

Bayelsa athletics boss Oredipe maps out dev plans Falcons stars dominate IFFHS Africa XI

Falcons stars dominate IFFHS Africa XI Eguavoen backs NPFL talents for Nigeria squad despite CHAN failure

Eguavoen backs NPFL talents for Nigeria squad despite CHAN failure He’s very strong, Simeone returns Osimhen praise

He’s very strong, Simeone returns Osimhen praise Joshua boxing return still uncertain

Joshua boxing return still uncertain NBA star Bane eyes Nigeria switch

NBA star Bane eyes Nigeria switch Palmer 'very, very happy' at Chelsea, says Rosenior

Palmer 'very, very happy' at Chelsea, says Rosenior_2.jpeg) AFCON 2025: VAR recording discloses what referee said before Morocco's penalty miss against Senegal

AFCON 2025: VAR recording discloses what referee said before Morocco's penalty miss against Senegal AFCON 2025 highlights: World-class stadiums, VAR drama, record attendance

AFCON 2025 highlights: World-class stadiums, VAR drama, record attendance Oliseh slams Osimhen for costing Eagles’ AFCON trophy

Oliseh slams Osimhen for costing Eagles’ AFCON trophy Rangers International going, going . . . (63,494 views)

Rangers International going, going . . . (63,494 views) Amaju Pinnick: A cat with nine lives (54,788 views)

Amaju Pinnick: A cat with nine lives (54,788 views) Second Term: Amaju Pinnick, Other NFF Heavyweights Home to Roost •How Pinnick Broke the Jinx (52,684 views)

Second Term: Amaju Pinnick, Other NFF Heavyweights Home to Roost •How Pinnick Broke the Jinx (52,684 views) Current issues in Nigerian sports: Matters arising (52,344 views)

Current issues in Nigerian sports: Matters arising (52,344 views) Sports Development: Zenith Bank on the zenith (52,277 views)

Sports Development: Zenith Bank on the zenith (52,277 views) Missing $150,000 IAAF Grant: Solomon Dalung’s Hide and Seek game (52,187 views)

Missing $150,000 IAAF Grant: Solomon Dalung’s Hide and Seek game (52,187 views) Gov. Abdullahi Ganduje’s solid footprints, commitment to sports development in Kano State (52,054 views)

Gov. Abdullahi Ganduje’s solid footprints, commitment to sports development in Kano State (52,054 views) NFF Presidency: Pinnick, Maigari, Ogunjobi, Okoye in Battle for Supremacy (51,608 views)

NFF Presidency: Pinnick, Maigari, Ogunjobi, Okoye in Battle for Supremacy (51,608 views) Olopade, BET9A wave of revolution in NNL (50,787 views)

Olopade, BET9A wave of revolution in NNL (50,787 views) Commonwealth Games 2018: Shame of Muhammadu Buhari, Solomon Dalung (49,314 views)

Commonwealth Games 2018: Shame of Muhammadu Buhari, Solomon Dalung (49,314 views) Ibrahimovic’s Man U exit: Whose decision is it? And in whose interest? (47,704 views)

Ibrahimovic’s Man U exit: Whose decision is it? And in whose interest? (47,704 views) John Mikel Obi: Segun Odegbami’s Outrageous Call! (47,172 views)

John Mikel Obi: Segun Odegbami’s Outrageous Call! (47,172 views)